In 2019 when IBM suddenly let go of nearly all its martech portfolio, I joked that it reversed an ancient adage: while perhaps “no one ever got fired for recommending Big Blue,” it turns out IBM can fire you. Yet, IBM was not alone. Big martech vendors — even successful ones — routinely jettison or replace longstanding tools.

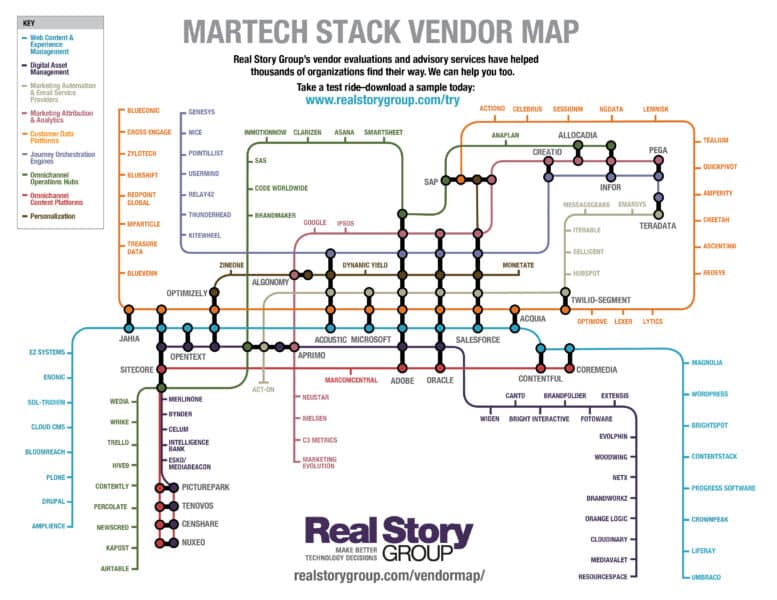

Yet, when it comes to perceived viability and stability, enterprise customers often fear smaller martech players. Early in my career as an industry analyst, I noticed that some of the best web content and experience management (WCM) solutions came from lesser-known vendors. Upon hearing this, my industry elders would pull me aside and say, “sure, but how much longer will that WCM vendor be around?” It’s a tough question to answer, because of course no one can ever really know, and martech marketplaces are highly fragmented. (“Fragmented” is analyst-speak for, you have a hell of a lot of choices!)

I tend to think the vast majority of the reported 8,000 martech vendors will survive, but fears will persist about individual vendor’s viability. Many smaller businesses do fail. Software vendors are no different, and who wants to get stuck with an unsupported product?

The myth of large-vendor stability

Two decades and much gray hair later in my analyst career, I’ve come to the conclusion that the very biggest vendors can actually carry the highest risks in terms of continuity. Big martech suite vendors aren’t going to fail as companies, but they will kill or replace individual products at the drop of the hat. Remember, they are constantly buying other vendors and calving off pieces of their portfolios. Meanwhile their own product strategies can shift quickly, due to staff turnover, equity market shifts or simple faddishness, to which all martech players are equally susceptible.

Let’s consider some examples:

- Google is infamous for killing platforms;

- Microsoft has gone through several incompatible renditions of marketing automation services around its Dynamics suite, and late last decade deprecated SharePoint as a public-facing WCM — giving up on its third attempt in this space;

- Not to be outdone, the latest Salesforce WCM offering is that vendor’s third attempt at this market (licensees of the first two attempts could not be reached for comment…);

- Salesforce also inconveniently licenses two CDPs today — likely an unsustainable situation for licensees of the ultimate loser;

- Adobe has had fewer démarches, likely because it’s been more circumspect in M&A, though fans of Macromedia digital tools may still hold some bitter memories; and

- Oracle has bought, sold, and developed such a wide array of overlapping digital and marketing platforms that a family tree would likely take up your entire screen — some acquired platforms endure, many have died of neglect.

What about smaller vendors?

Smaller vendors, especially those focused on one platform, are staking their corporate lives on their offering. Their product could still weaken over time, and as a customer you need to stay on top of innovation and support levels. Or the vendor could shift its roadmap significantly, with negative consequences for you. But you much more rarely see a capricious decision to discontinue it outright.

Could that smaller, focused vendor still go kaput? Sure. Can open source projects wither? Absolutely. Could your small martech vendor get acquired? Sure, in fact many of them are counting on it! Usually they’ll get acquired by a larger firm, for good reason (e.g., to fill in a portfolio gap). Other times they’ll get acquired by an investment firm or other roll-up, often after stalling in the market. The new owners milk support revenues for several years — not great for you, but not a disaster either.

Take a broader look at risk

That last example hints at a potentially more disruptive risk than financial viability. It turns out that size of technical debt is a good predictor of something drastic happening to a platform or vendor. Heavy technical debt can lead to platform retirement or a massive overhaul — what wags sometimes call “forklist upgrades” — effectively a wholesale replacement. If your firm has ever deployed Drupal 6 and Drupal 7, or Salesforce Sales Cloud, or Adobe Campaign or any number of other platforms that have seen nearly complete rebuilds, then you can relate.

So, at RSG we’ve learned to look at viability and continuity risks as a multi-dimensional challenge — alongside stability and a thriving product development operation — as a basket of strategic issues to explore when performing vendor diligence. In our RealQuadrant decision-support tool, they figure prominently among the “Strategic Considerations” factors that make up the Y axis of the custom quadrants that get generated.

In sum, remember that you can experience different types of turbulence, and vendor size is just one piece of the puzzle. Happily, Big Blue sold off most of their martech portfolio to Acoustic, an investor-funded firm staffed with many former IBMers, and HCL, a well-known integrator. At Acoustic and HCL these platforms have not excelled in the marketplace, but they’re still supported, so basic viability has been sustained.

Still, if you look beyond viability and explore a broader set of risk factors, the biggest vendors will not always present your best protection.

Real Story on MarTech is presented through a partnership between MarTech and Real Story Group, a vendor-agnostic research and advisory organization that helps organizations make purchasing decisions on marketing technology applications and digital workplace tools.

The post Real Story on MarTech: Sometimes the biggest vendors carry the biggest risks appeared first on MarTech.