How are mom-and-pop self-storage facilities meant to keep up with the tech offered by the massive, ever-growing chains?

That’s a key part of the idea behind OpenUnit, a team I first wrote about in August of last year. You bring the storage units, they bring the website, payment processing, and backend tools you need to manage them. They don’t charge facility owners a monthly subscription fee, instead taking a cut of each payment as the payments processor.

OpenUnit has now raised a $1M seed round, and acquired the IP of a fellow YC company along the way.

Since we last heard from OpenUnit, they’ve been expanding to locations around the US and Canada and now have a waitlist over 800 facilities deep, the team tells me.

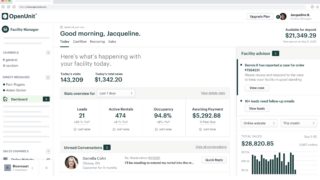

Image Credits: OpenUnit

OpenUnit co-founder Taylor Cooney was quick to point out that this seed round is as much about strategic partnerships as it is about the money. Neither Taylor nor co-founder Lucas Playford had much to do with the storage industry until a knock at the door led them down a rabbit hole. As I wrote back in August:

“…Taylor’s landlords came to him with an offer: they wanted to sell the place he was renting, and they’d give him a stack of cash if he could be out within just a few days. Pulling that off meant finding a place to keep all of his stuff while he looked for a new home, which is when he realized how antiquated the self-storage process could be.”

Of the 20+ investors participating in the round, 6 are from the self-storage industry, from prior/current facility owners to the Director of the Canadian Self Storage Association. For some of them, it’s their first time investing in a tech or software company — but all potentially bring something to the table beyond money.

Of course, that’s not to say they’re just letting that money sit around. They’ve grown the team from just Taylor and Lucas up to five, and are still looking to grow. Meanwhile, Taylor tells me that the company has acquired the IP of fellow Y Combinator W20 batchmate Affiga, a product that aimed to automatically provide insights about a new customer after a transaction is made.

Writes Taylor: “As self-storage companies move services like rentals, leases, and payments online, it’s becoming increasingly difficult for them to ‘know’ their customers. We see the integration into our product as a way to help self-storage operators bridge the gap between their online and in-store customer experiences, where the personal touch tends to be lost.”

Affiga initially shutdown its operations back in 2020. After OpenUnit realized they wanted something similar in their product, they set out to buy rather than build. “With a decade in e-commerce under their belt,” Taylor tells me, “their founder had a much better approach to this then we would’ve come up with.”

So what’s next? Besides getting more people off the waitlist and onto the platform, they’re exploring other opportunities, including potentially providing loans to facilities looking to expand or renovate. Because OpenUnit is both the management platform and the payments provider, they have deep insights on how a facility is doing; they know how much a location makes, how punctual their customers are with payments, etc. Take that data and mash it up with insights on what improvements can increase revenue, and it seems like a pretty straightforward formula.

This round includes investment from Garage Capital, Advisors Fund, Insite Property Group, SquareFoot co-founder Jonathan Wasserstrum, and a number of angel investors.