Digital media outfit BuzzFeed announced today that it will go public via a SPAC, or blank check company. BuzzFeed also disclosed that it will purchase Complex, another media company, for $300 million in cash and shares in BuzzFeed itself; the SPAC deal will help finance its purchase of Complex.

The transaction will see BuzzFeed merge with 890 Fifth Avenue Partners Inc., a public company, with the combined entity sporting an enterprise valuation of around $1.5 billion after its completion.

BuzzFeed’s SPAC partner is bringing $288 million in cash to the table, and BuzzFeed intends to raise another $150 million in a convertible debt offering.

In raw numbers, BuzzFeed is a large company with hundreds of millions of dollars in yearly revenue and a roughly break-even business in recent years. The company’s investor presentation anticipates a return to growth after a mostly flat 2020, and rising profitability over time.

So let’s get into the company’s investor presentation. We want to know about its historical growth, anticipated growth, revenue mix and profitability, as well as how the company thinks about its news division. Let’s go!

I’ve broken each of our points into its own mini-section, so if you want to skate ahead to any particular point, feel free!

Historical revenue growth

Why is BuzzFeed buying Complex? In part, because it adds audience scale to its platform, a key to the company’s expected future advertising revenue growth (more on that in a moment). But also because Complex adds a lot of revenue to its overall top-line picture.

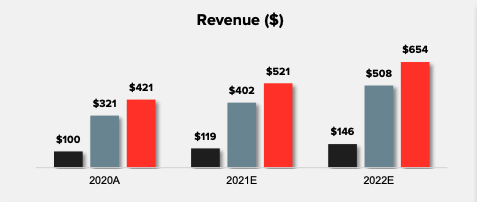

For example, in BuzzFeed’s historical revenue figures we see the following numbers:

- 2019: $425 million

- 2020: $421 million

But the company’s historical results are inclusive of Complex. Here’s the breakdown of the company’s historical revenues (gray) and Complex’s own (black). The combined figures are what BuzzFeed notes in its trailing metrics:

Image Credits: BuzzFeed SPAC deck

From this breakdown, we can see that BuzzFeed anticipates 19% growth from Complex in 2021, and just under 23% growth from the group it’s acquiring in 2022.

Per a later slide, BuzzFeed grew 4% in 2019, inclusive of historical Complex numbers. That figure fell to -1% in 2020.

Our read of the company’s historical revenue growth is that it weathered a turbulent 2020 in reasonable health; digital advertising took a huge hit in the first half of the year, likely impacting BuzzFeed’s operating results. To see it manage an essentially flat revenue result last year feels pretty OK.